全球化正在发展,中国的跨国公司必须适应 - 2023-02-20

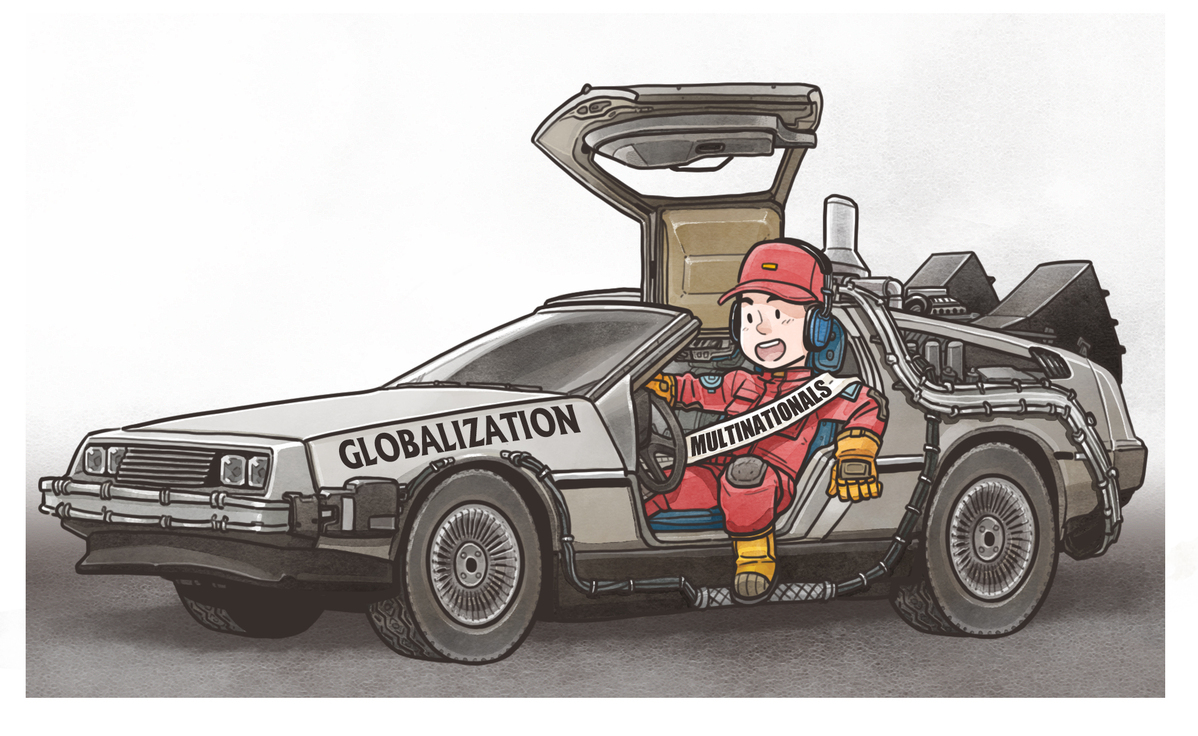

The past 30 years have been a time of rapid globalization, an era in which multinational companies (MNCs) tapped global capital, built businesses optimized for global supply and demand, and served customers worldwide. Possibly the most remarkable story of that phenomenal era was China's economic transformation — a transformation in which MNCs played an integral part. Real GDP in China grew by almost 10 percent per year between 1990 and 2019, representing more than a quarter of the world's GDP growth, as the country opened its economy, played an increasingly important role in manufacturing, moved into many other industries and saw its consumer base expand. MNCs flocked to China during the period, accounting for more than half of the country's exports at one point and helping bring best practices to China from around the world.

But the earthshaking developments of the past few years have changed MNCs' global outlook. Inflation has shot up. A worldwide pandemic has killed millions, battered economies and exposed weaknesses in supply chains. War has exacerbated those economic challenges. These developments have led some to suggest that an era of deglobalization is at hand. If that is so, the implications for MNCs in China would be profound.

We think that the reality is more nuanced. China continues to offer MNCs large and attractive opportunities. At the same time, it presents companies with increasingly complex risks. For MNCs in China, the challenge will be to seize the former while managing the latter.

Beginning with the opportunities, the major one is China's sheer size, which ensures that it will retain MNCs' attention. Its GDP is now 18 percent of the global total, a share equal to the entire European Union's and second only to that of the United States. Even if China's real GDP grows at just 2 percent from 2021 to 2030, the additional GDP alone will be larger than India's total GDP in 2021. In some industries, such as cars, luxury goods and industrial equipment, the China market already represents 25 to 40 percent of global revenues and MNCs in those industries will have no choice but to compete there.

Furthermore, continued urbanization and the growth of the middle-income group are making China's big consumer base even more prodigious, which will power demand across a broad range of industries. Today, roughly 65 percent of the country's population live in cities, a share that is projected to grow to 71 percent by 2030 and 80 percent by 2050. That urbanization will help lift more of the population into the middle-income group. According to our analysis, the share of China's population living in cities with a per capita GDP higher than $12,695 — a level that the World Bank uses to designate a country as a high-income economy — will grow from 27 percent in 2020 to 44 percent in 2030.

But MNCs operating in China also face growing risks. For example, China's population fell in 2022, and it is aging at the fastest pace among the world's emerging economies. China's dependency ratio — the number of children and elderly divided by the number of working-age people — is expected to increase from 45 percent in 2021 to 71 percent by 2050, the same ratio as Japan's today. Meanwhile, China's debt-to-GDP ratio is at a historic high, which could generate heavy debt servicing costs and put pressure on overall economic growth.

MNCs in China are also exposed to risks from climate change. Asia as a whole is expected to account for more than 75 percent of the global capital stock that could be damaged from river flooding in a given year. In 2020, 4 percent of outdoor working hours were lost to extreme heat and humidity in climate-exposed regions in China, and the share could grow to 7 percent in 2030 and 9 percent in 2050, affecting companies' productivity and operations.

If MNCs want to seize opportunities and reduce risks, they will need to adapt. That need is all the more pressing because of the growing local competition they face. MNCs' share of all revenues earned in China declined from 16 percent to 10 percent from 2006 to 2020. Furthermore, local companies are catching up in innovation-related investment, ramping up their R&D spending more quickly than MNCs. Between 2017 and 2021, according to our analysis, local companies' R&D spending grew three times as quickly as MNCs' global R&D spending.

However, high-performing MNCs maintained their position well during the pandemic. Of Fortune 500 companies that disclosed their revenues in China, high performers (defined as those with growth rates between 2010 and 2021 that were higher than the 75th percentile) saw their revenues grow by 16 percent per year between 2010 and 2019 and then by 20 percent between 2019 and 2021. By contrast, low performers (those with growth rates lower than the 25th percentile during the whole period) saw their revenues shrink by 3 and 5 percent per year during the two shorter periods. In other words, the gap between high- and low-performing MNCs has widened since the pandemic began.

There are six broad areas in which MNCs will have to make careful choices to reconfigure their China strategy: capital and ownership, supply chains, innovation, branding, talent, and technology and data. With supply chains, for example, MNCs have a range of options, including implementing an "in China, for China" strategy, in which components are produced in China for domestic production and sales, building a regional supply chain for both China and nearby markets, and maintaining a global supply chain of which China is one part. Local supply chains can enhance efficiency and agility and can reduce the time it takes to respond to changing demand. At the same time, global supply chains allow companies to allocate resources dynamically and comply with regulatory requirements, and they can enhance MNCs' resilience, as many discovered during the pandemic when localized supply chains and concentrated production resulted in shortages.

The answers will be different for every MNC. Some may choose to double down by renewing their commitment to China, while others may reduce their stakes in China. But in general, MNCs will play an important role in reimagining the relationship of China and the rest of the world. The world remains deeply interconnected and resilience comes from more interdependency, not less. China is changing and presenting MNCs with a challenge — how to take advantage of significant opportunities while managing emerging risks. It is an imperative that will define the next era for MNCs, and those that solve it will be tomorrow's winners.

The author is Jonathan Woetzel, a McKinsey senior partner and director of the McKinsey Global Institute in Shanghai. Jeongmin Seong is an MGI partner in Shanghai.

Source: China Daily